In today’s fast-paced world, online loans have become increasingly popular for individuals seeking quick and hassle-free access to money. With just a few clicks, you can apply for a loan from the comfort of your own home and receive funds directly into your bank account. But like any financial decision, there are pros and cons […]

Tag Archives: Loan

Getting approved for a loan can be a challenging and bureaucratic process. However, it is an important step for many people who need financial help to reach their goals. Whether it’s buying a house, acquiring a vehicle or investing in a new venture, having access to a loan can be the ideal solution. However, before […]

Managing loan repayments effectively is crucial for individuals and businesses alike. When we borrow money, whether it’s for personal reasons or to support the growth of our business, it’s essential to have a plan in place to repay the loan within the agreed timeframe. However, unexpected circumstances and financial challenges can sometimes make this task […]

In times of financial crisis, it is common for many people to look for ways to alleviate the pressure of debt and find more affordable ways to pay. A very interesting option is loan refinancing, a process that can bring significant benefits to those looking to save money and better organize their finances. In this […]

Understanding interest rates is essential when it comes to taking out a loan. Whether you’re considering getting a mortgage, personal loan, or even financing a car, knowing how interest rates work can save you from making costly mistakes and help you make informed financial decisions. In this comprehensive guide, we will break down the concept […]

Applying for a loan can be a daunting process, especially if you’re unfamiliar with the ins and outs of the lending industry. Whether you’re looking to finance a new car, start a business, or simply consolidate your debts, it’s crucial to navigate the loan application process with caution. Unfortunately, many individuals fall victim to common […]

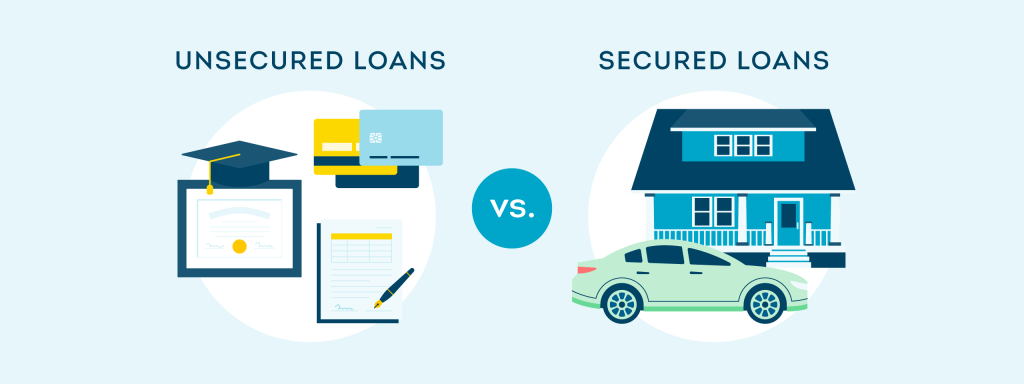

When it comes to borrowing money, understanding the different types of loans available is crucial. Two common options are secured and unsecured loans. While both serve the purpose of providing financial assistance, they differ in terms of requirements, interest rates, and risk factors. In this article, we will explore the differences between secured and unsecured […]

Do you need some extra money for a vacation, home renovation, unexpected medical expenses, fulfilling a dream or even an emergency? Personal loans are a great solution to meet your financial needs. However, with so many options available, it can be difficult to choose the right bank for your loan. That’s why we’ve put together […]

Getting a loan from PNC Bankcan feel big, especially when you’re on maternity leave. Knowing the PNC Bank loan steps and what they look at—like your job, credit, and security—can make it easier. Be ready to show you can work again and any short-term money, such as disability or family leave. This gets you ready […]

Are you in need of some quick and easy financial assistance? Whether it’s for unexpected expenses, debt consolidation, or simply to fund a personal project or dream, taking out a personal loan can provide the financial support you need. And when it comes to getting a personal loan, Avant is a top choice for many […]